China’s Rare Earth Clampdown Triggers EV Motor Shake-Up – Can Tesla, BMW, and India’s Electric Dream Survive the Magnet Crunch

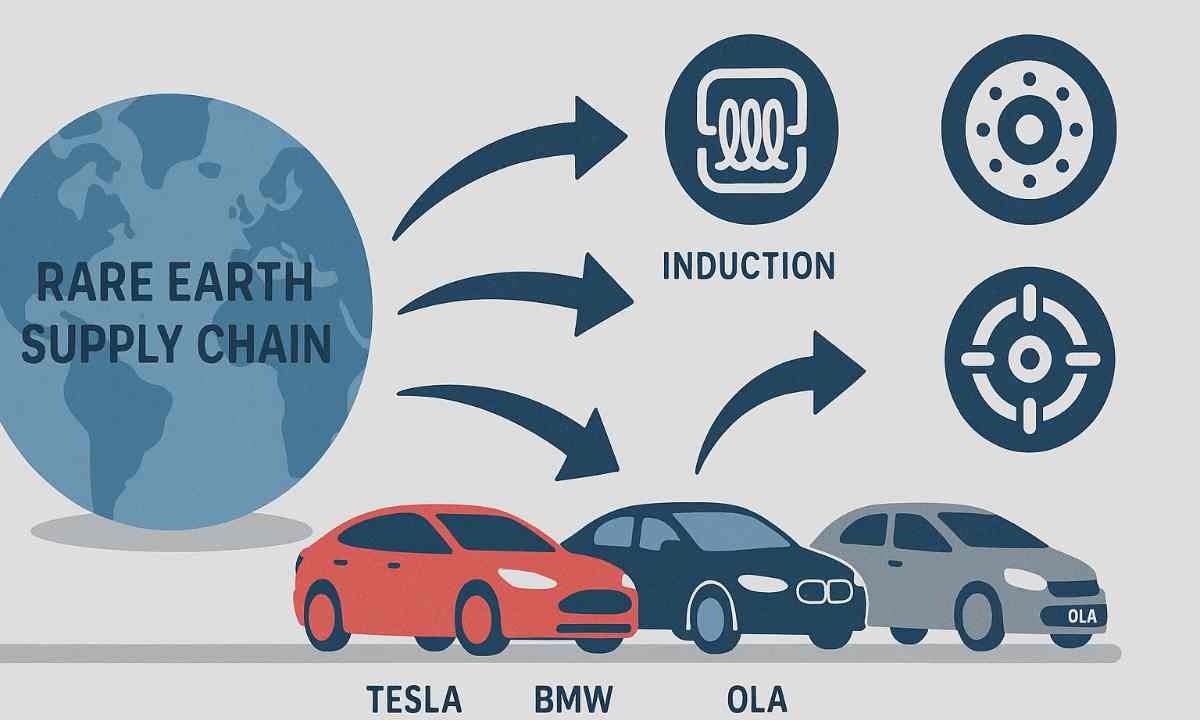

China’s tight grip on rare earth magnets—a key component in electric vehicle (EV) motors—has kicked off a global race to find magnet-free alternatives. With more than 80% of EVs using permanent magnet synchronous motors (PMSMs), this supply disruption is forcing big names like Tesla, BMW, and Indian EV makers to rethink how they power their vehicles.

The Magnet-Free Motor Revolution

Here’s how companies are dodging the rare earth roadblock:

1. Induction Motors – Tesla’s Early Choice

-

What it is: No permanent magnets, works using electromagnetic induction.

-

Efficiency: 85–95%

-

Power Density: 1–3 kW/kg

-

Pros: Cheaper by 20–30%, durable build.

-

Used In: Early Tesla models like the Roadster and Model S.

2. Switched Reluctance Motors (SRM)

-

Magnet-free design, built with just steel and copper.

-

Cost: Up to 60% cheaper than PMSMs.

-

Cons: Can be noisy with torque ripple; needs advanced control systems.

3. Wound-Field Synchronous Motors (WFSM)

-

Uses electromagnets instead of rare-earth magnets.

-

Efficiency: 90–96%

-

Cost: 15–25% lower than traditional magnet motors.

-

In Use: Renault ZOE, and some Indian EV prototypes.

4. Externally Excited Synchronous Motors (EESM)

-

BMW’s fifth-gen eDrive skips rare earths entirely.

-

Efficiency: Sometimes 4% better than PMSMs.

-

Models: BMW i4, i7, and iX.

Next-Gen Motor Tech: What’s Coming Up

-

Iron Nitride Magnets (Niron Magnetics): 50% cheaper and 40% lighter.

-

Axial Flux Motors (Mercedes YASA): Delivers 31 kW/kg — ultra-compact power.

-

ZF’s I2SM Tech: No brushes, 15% less energy loss.

India’s EV Sector Faces a Tough Choice

As EV adoption speeds up in India, homegrown players like Bajaj Auto, Ola Electric, and TVS are feeling the heat. They currently rely heavily on rare earth imports from China, and that’s turning into a big risk.

-

Material Price Shock: Rare earth magnets cost around $100/kg, while ferrite alternatives are just $5–7/kg.

-

What’s at Stake: Factory slowdowns, rising prices, and subsidy stress.

But it’s not all doom and gloom. This challenge could be a golden opportunity for Indian companies to leap ahead by investing in induction, SRM, and wound-field motor technologies—cutting costs and gaining independence from China’s supply chain.

A Crisis or a Catalyst

This rare earth crunch is more than a supply hiccup—it’s a global wake-up call. Tesla and BMW are already proving that alternatives can work. For India to stay in the race, it’ll need serious investment in R&D, smarter motor strategies, and strong government backing. The future of EVs might just run on innovation instead of rare earths.